Market Conditions

Green Iron and Steel

- Globally steel accounts for around 8% of total emissions;

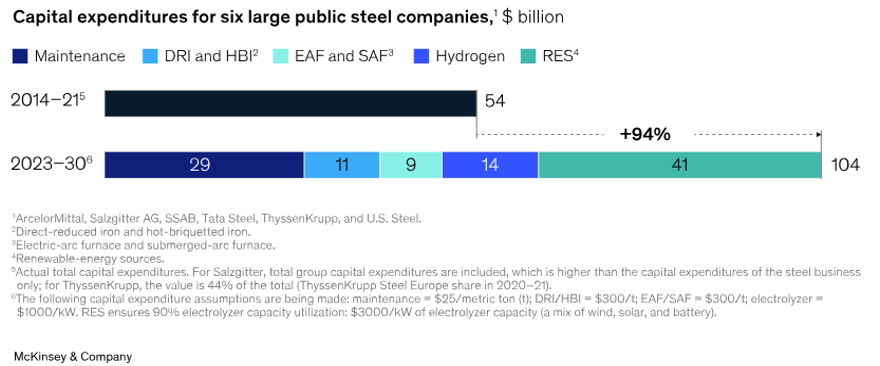

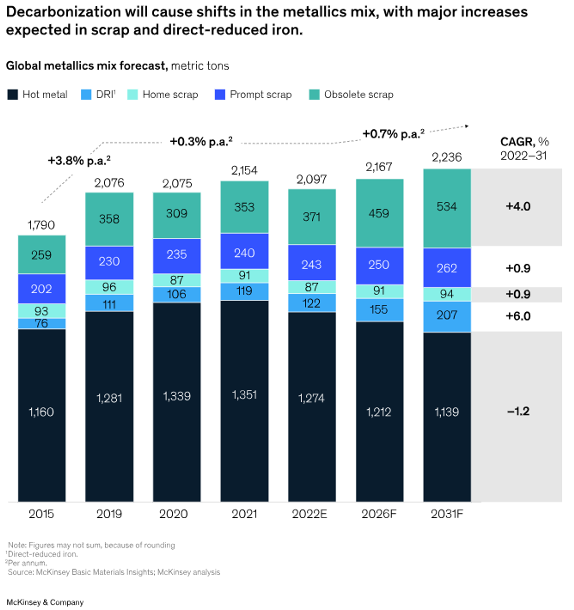

- According to McKinsey & Co., low CO2 Steel demand (i.e green DRI and HBI) is expected to grow from 15mtpa to 200 mtpa by 2030, or 10% of steel demand;

- Green premiums are expected to reach $200-350/t by 2025 and $300-$500/t by 2050;

- The capital investment required is significant and is likely to develop around hubs with high quality resources of suitable ore and renewables;

- GDA have good relationships with the complete supply chain from RE to offtakes which can deliver an integrated solution with syndicated risk.

Future Product Positioning

Magnetite Concentrate Commands a Premium

High iron content improves plant efficiency

- Once concentrated, magnetite ore usually reached grades of c. 65%

- Produces more refined iron per tonne of raw material

- Quicker and more efficient in time, energy and cost than lower grade iron ores

High iron content reduces emissions

- Use of higher-grade iron ore requires less metallurgical coal to be used per tonne of steel produced, lowering carbon emissions and is critical to the transition towards de-carbonization

Lower levels of impurities to process out or contaminate final products

- Magnetite ores generally contain less alumina, silica and phosphorus than hematite ores

- Impurities can impact the quality of steel and must be removed – increasing energy requirements

- Lower levels of impurities found in magnetite ores simplify and reduce energy requirements in steelmaking and are therefore sought after

Reduced nature of the feedstock

- Produces an exothermic reaction in the furnace, lowering input energy requirements and associated costs

The majority of traded magnetite iron ore is consumed in China

- China’s BF-BOF steel making plants use ~10% magnetite concentrate

- Pellet plants in China rely on older technology and are designed to process only magnetite concentrate

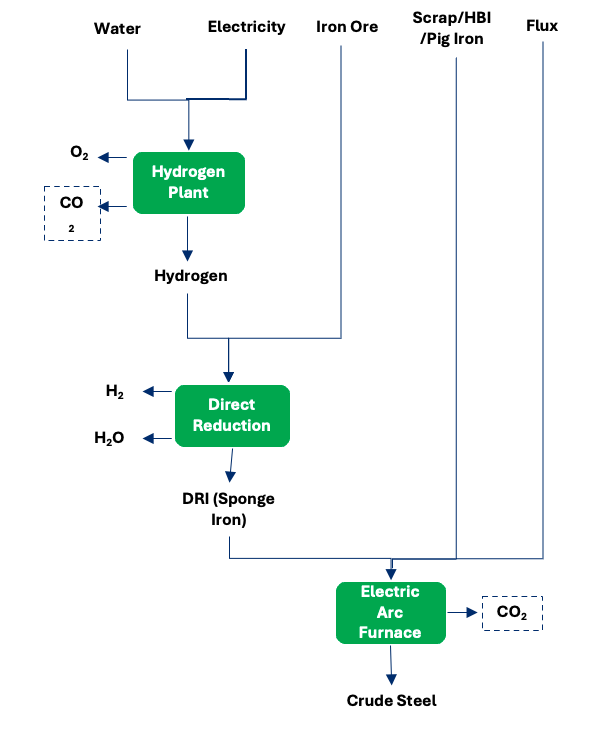

Green Hydrogen – Proposed Steel Production Method

Source: Morgan Stanley Research and Wood Mackenzie

Capitalising on Green Iron Ore

Key Commentary

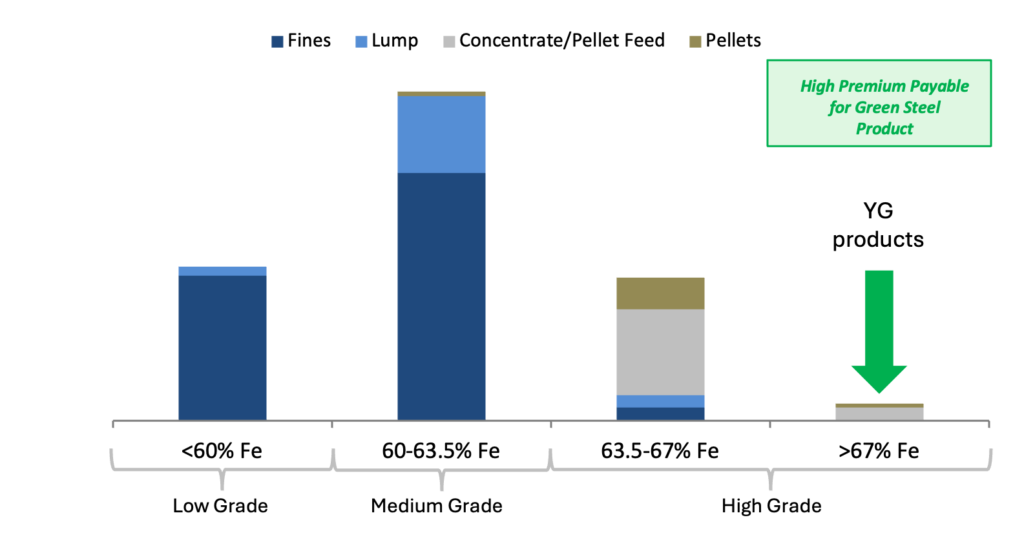

High-grade iron ore consumption expected to increase five-fold to 750Mtpa by 2050 with US$95B – US$125B to be spent on high-grade ore exploration

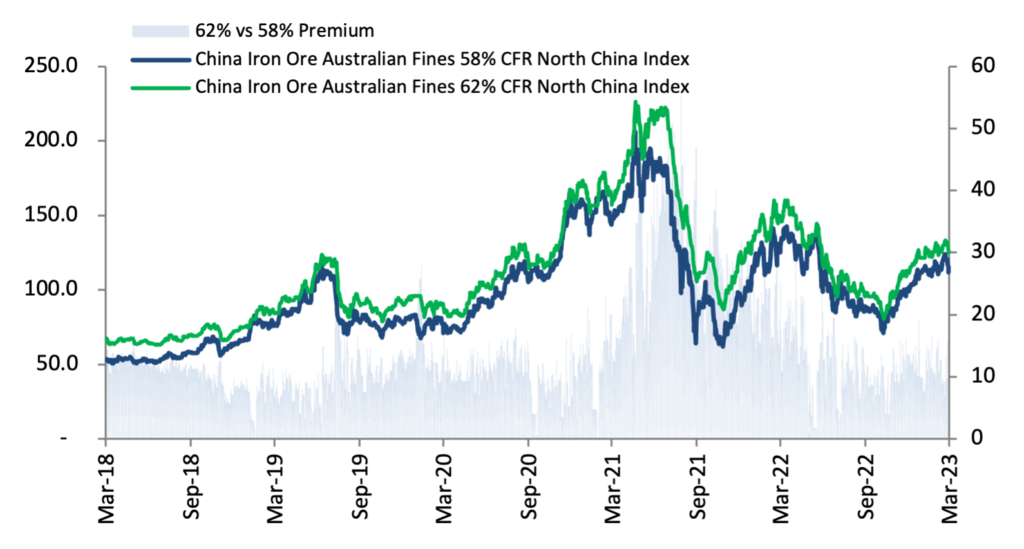

Environmental regulatory and operating efficiency pressures should mean higher-grade iron ore products become more valued over time and achieve higher premiums

Lower-grade product discounts are likely to remain substantial (~20%) below reference index prices – unless they have valued properties

- i.e. sintering productivity; low alumina, phosphorous, sulphur, and contaminants, high LOI/calcined grade

Green operations are expected to attract premiums of up to ~US$80/t by 2025 and up to ~US$100 from 2030+

- PAO is positioned to capture this premium through the production of a high grade (68%) concentrate from the proposed wet beneficiation plant at Port Playford

- Robust long term cashflows will underpin further growth and potential port expansion

The green qualities of PAO’s future product will demand significant interest from customers and will be attractive to equity and / or financing partners seeking ‘green’ investments

62% vs. 58% Fe Index

Seaborne Iron Ore Volumes by Product and Grade

Source: Bloomberg